“The essence of investment management is the management of risks, not the management of returns.” -Benjamin Graham

Understanding the Relationship Between DSCR and Cap Rate

As real estate investors, we’re always seeking to balance risk, financing, and returns. Two of the most important metrics in this process are Debt Service Coverage Ratio (DSCR) and Capitalization Rate (Cap Rate). While they are often discussed separately, these two numbers are deeply connected—and together, they play a crucial role in determining property value, financing terms, and investment viability.

What is DSCR?

Debt Service Coverage Ratio (DSCR) measures how well a property’s net operating income (NOI) covers its debt obligations.- 1.0 DSCR: Property income just covers debt service.

- 1.25+ DSCR: Healthy margin of safety.

What is Cap Rate?

Capitalization Rate (Cap Rate) represents the expected return on an all-cash purchase of a property. Formula:Cap Rate = Net Operating Income ÷ Purchase Price

- Lower Cap Rates: Safer markets, higher valuations, lower returns.

- Higher Cap Rates: Riskier markets, lower valuations, potentially higher returns.

How DSCR and Cap Rate Work Together

At first glance, DSCR and Cap Rate seem like separate tools: one measures financing strength, the other measures valuation. But they’re linked. As cap rates compress (property prices rise), the same income produces a lower DSCR, which makes financing harder.

That means:

- A property can look attractive on paper at a low cap rate, but its DSCR might fall below lender thresholds.

- Conversely, a property at a higher cap rate may have a stronger DSCR, giving you better leverage and higher potential returns.

A Scenario in Numbers

Let’s look at three versions of the same property, each priced differently because of market cap rates.

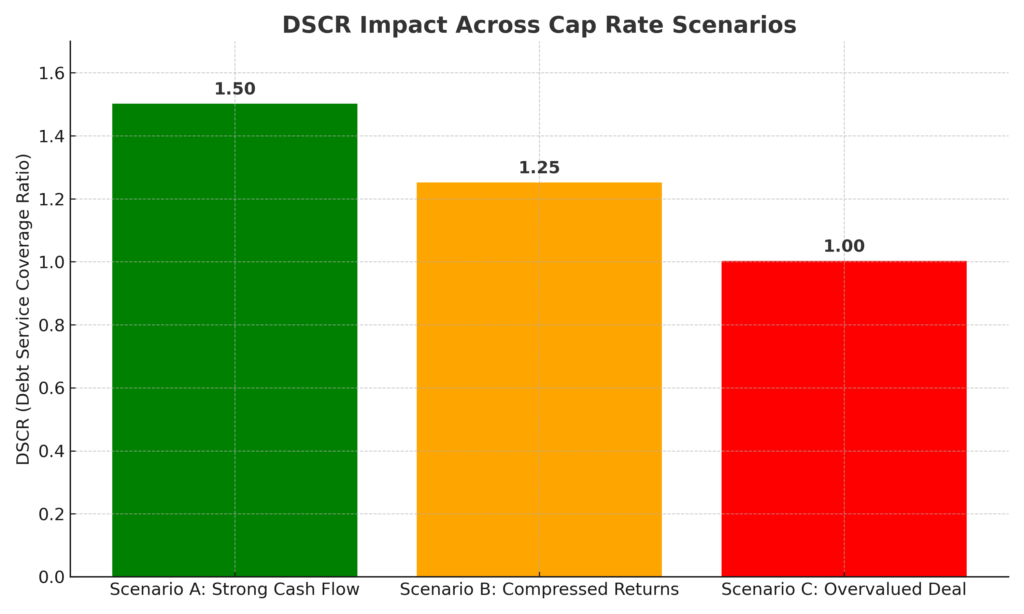

📊 DSCR Impact Across Cap Rate Scenarios

Scenario Highlights:

- Scenario A: Strong DSCR (1.50) → lenders confident, higher leverage available, better returns.

- Scenario B: Moderate DSCR (1.25) → financeable, but requires more equity; returns squeezed.

- Scenario C: Weak DSCR (1.00) → break-even; lenders may restrict or reject financing.

Conclusion:

Putting DSCR and Cap Rate to Work

As a passive investor, you don’t need to run complex spreadsheets — but understanding DSCR and Cap Rate gives you the confidence to ask the right questions and recognize strong opportunities.

- Start with Cap Rate to see if the property is being purchased at a fair value relative to its income — especially when compared to the cap rates of recently sold comparable properties in the same market.

- Check DSCR to ensure the projected income comfortably covers the debt. As a rule of thumb, lenders typically look for at least 1.25 DSCR — meaning the property produces 25% more income than the debt payment. Anything much lower than that signals higher risk.

- Look at them together to understand whether financing will enhance or dilute your returns.

By knowing that cap rate must be viewed in relation to the market, and that DSCR below ~1.25 may be a red flag, you can evaluate opportunities with more confidence, avoid unnecessary risk, and focus on investments built for stability as well as growth.

Next Steps:

If you’re ready to explore passive real estate investing with a team that prioritizes disciplined underwriting and investor alignment, we invite you to take the next step.

We’ll walk you through current opportunities, explain how we apply these metrics in our evaluation process, and answer any questions about how real estate syndication can fit into your portfolio.