What Is a Preferred Return?

A preferred return is a contractual promise that investors will receive a fixed annual return on their capital before the sponsor or general partner (GP) shares in any profits. It is the investor’s “first claim” on cash flow.

Preferred returns are typically set between 7–8% annually, based on the invested capital, and may be cumulative — meaning if it is not paid in full one year, the unpaid amount accrues and must be caught up in future years.

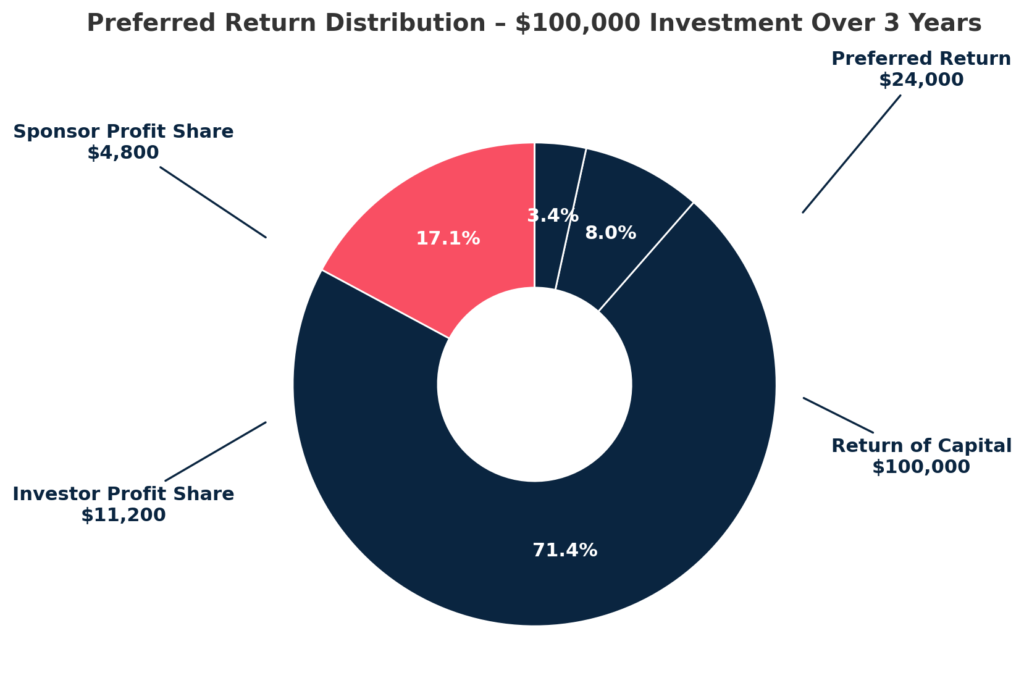

How It Works: A Simplified Waterfall Example

Imagine investing $100,000 in a deal with:

- An 8% preferred return

- A 3-year hold period

- A $40,000 profit generated over that time

Here’s how distributions would flow:

- Preferred Return Paid First:

$100,000 × 8% × 3 years = $24,000 - Return of Capital:

Your full $100,000 is returned - Remaining Profit Split:

$40,000 – $24,000 = $16,000 left

→ 70% to Investor: $11,200

→ 30% to Sponsor: $4,800 - Total Investor Distribution:

$24,000 (pref) + $100,000 (capital) + $11,200 (profit share) = $135,200

Why Sponsors Use Preferred Returns (and What It Says About the Deal)

Preferred returns are not just a technical feature — they reflect how the sponsor views risk, alignment, and deal confidence:

- Risk Allocation: Sponsors only participate in profits after investors are paid. This protects capital and reduces conflicts of interest.

- Market Confidence: A preferred return structure only works if the deal produces real, predictable cash flow. Sponsors offering it are putting performance behind their pitch.

- Investor Expectations: Experienced investors — including family offices and institutional LPs — often expect a pref. Including one signals professionalism and preparedness.

What Investors Often Overlook

A preferred return is often viewed as “icing on the cake” — but it is more strategic than that. Here is what savvy investors understand:

It is About Downside Protection, Not Just Upside

Preferred returns function as a performance threshold. They do not guarantee a windfall — they guarantee sequence. Investors get paid first. That is powerful in volatile markets.

It Can Shift the Return Profile

You may trade some potential upside for greater income certainty and principal protection. That is often a good trade — especially if you are relying on predictable cash flow or planning for retirement.

Not All Preferred Returns Are Created Equal

Be wary of:

- Non-cumulative structures: If missed, your pref vanishes

- Back-ended distributions: Paid only at sale, not from operations.

- Sponsors earning promote before you are whole: Misaligned incentives.

At Cramlet Capital, we have structured our offerings with cumulative preferred returns, and we do not participate in profits until investors receive both their preferred return and full return of capital.

What This Means for You as an Investor

Understanding how preferred returns work — and when they benefit you — is foundational to building a smart real estate portfolio. They:

- Prioritize your capital

- Protect your downside

- Align sponsor incentives

- Establish transparency and predictability

That is why we include a pref in every offering — and why we are proud to stand behind structures that reward discipline, not just optimism.

Conclusion

Preferred returns are more than just a technical concept — they are a cornerstone of investor-focused deal design. In today’s uncertain environment, investors do not just want upside — they want clarity, priority, and protection.

At Cramlet Capital, we structure every offering with institutional-grade discipline. Preferred returns are one of many ways we align with our investors and pursue strong, risk-adjusted performance across every multifamily acquisition.

Next Steps: Bring These Investor Protections Into Your Portfolio

If you are evaluating your next move in real estate private equity — or simply want to understand how Cramlet Capital structures deals for performance and protection — we would love to connect.