The Role of Investment Analysis in Real Estate Private Equity

A real estate investment analysis is the foundation of any smart investment strategy, whether you’re evaluating multifamily syndications, private equity real estate funds, or commercial real estate investments. Understanding an asset’s cash flow potential, valuation, and risk factors is essential for making informed decisions and maximizing returns.

Unlike single-family rentals, larger multifamily properties and commercial real estate assets are valued based on income generation rather than comparable sales. This means that an in-depth financial analysis is necessary to:

- Determine expected cash flow and return on investment (ROI).

- Assess risk factors and potential value-add opportunities.

- Compare actual property performance against pro forma projections.

Whether you’re an accredited investor looking for passive income or a new investor exploring real estate private equity, this guide will help you understand the key metrics behind evaluating multifamily investments.

Key Elements of Real Estate Investment Analysis

A thorough investment analysis involves multiple steps to evaluate a property’s potential. While no forecast is 100% accurate, a data-driven approach helps investors minimize risks and maximize their return potential.

1. Understanding Property Performance: Cash Flow vs. Appreciation

In real estate private equity, there are two primary drivers of returns:

- Cash Flow: The net income left after all expenses and debt service.

- Appreciation: The increase in property value over time, driven by market growth and value-add improvements.

While appreciation is difficult to predict, cash flow can be accurately projected based on rent rolls, operating expenses, and market trends. Most institutional investors and syndicators focus on cash flow first since it provides immediate, predictable returns.

2. Core Investment Metrics for Real Estate Analysis

A strong financial model provides insights into an asset’s investment potential. Here are the key metrics every investor should evaluate:

Net Operating Income (NOI): The Foundation of Property Valuation

NOI represents the property’s profitability before debt payments. It is used to determine valuation and assess investment performance.

Capitalization Rate (Cap Rate): Benchmark for Valuation

Cap rates help investors compare returns across different markets. A lower cap rate typically means a more stable asset in a strong market, while a higher cap rate indicates higher risk but potentially higher rewards.

Cash-on-Cash Return (COC): Measuring Investor Cash Flow

COC measures the actual cash return on invested capital. This is a critical metric for limited partners (LPs) investing in syndications or real estate funds.

Internal Rate of Return (IRR): True Investment Performance Over Time

IRR considers cash flow, appreciation, and time value of money, providing a comprehensive return measurement. A higher IRR suggests stronger long-term returns.

Equity Multiple: Measuring Total ROI

An equity multiple of 2X means an investor doubled their initial investment. In syndications, typical deals target a 1.8X to 2.5X equity multiple over 3-7 years.

3. Pro Forma vs. Actual Data: Avoiding Over-Optimistic Assumptions

Sellers often provide pro forma financials that reflect the most optimistic scenarios. Smart investors must validate assumptions by:

- Reviewing tax returns and rent rolls from the past 3-5 years.

- Verifying actual operating expenses to avoid underestimating costs.

- Conducting a sensitivity analysis to test worst-case scenarios.

Comparing pro forma (projected) vs. actual performance data is key to avoiding misleading ROI projections.

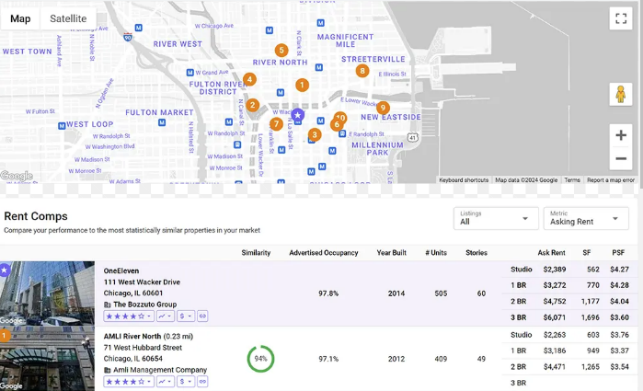

4. Comparative Market Analysis (Comp Analysis): Benchmarking the Asset

Multifamily and commercial properties cannot be valued based on nearby home sales. Instead, investors use comparative market analysis (CMA) to evaluate:

- Rental Comps – Compare similar units to determine market rent potential.

- Sales Comps – Compare recent sales of similar income-producing properties.

- Expense Comps – Ensure operating expenses align with market standards.

This approach helps determine whether a deal is priced competitively or if there’s upside potential.

5. Income Approach: Understanding Property Revenue Streams

Income analysis is a critical part of real estate valuation. Investors must account for:

- Rental Income – Projecting long-term market rent growth.

- Ancillary Income – Parking fees, laundry, storage, pet fees, and other non-rental revenue.

- Vacancy & Credit Loss – Assessing realistic occupancy rates.

Example of adding value:

A 100-unit apartment charges $60 per unit for in-unit washer/dryers, generating:

100×60=6,000 per month=72,000 per

At a 6% cap rate, this increases the property’s value by $1.2M.

6. Expense Analysis: Controlling Costs for Maximum Profitability

Expenses must be carefully analyzed to protect NOI and cash flow. Key expense categories include:

- Property taxes and insurance

- Maintenance and capital expenditures (CapEx)

- Property management fees

- Marketing, leasing, and tenant turnover costs

- Utilities and landscaping

Even small cost increases can significantly impact NOI, making accurate expense forecasting critical.

7. Tax Advantages: Enhancing Returns with Bonus Depreciation

Real estate investment offers powerful tax incentives that enhance returns, such as:

- Depreciation & Cost Segregation – Reducing taxable income by accelerating depreciation.

- 1031 Exchanges – Deferring capital gains taxes by rolling proceeds into new investments.

- Self-Directed IRA (SDIRA) Investing – Growing wealth tax-free or tax-deferred.

Through bonus depreciation (available until 2026), investors can write off 40-80% of the asset’s cost in year one, creating significant tax savings.

Real Estate Private Equity: A Hands-Off Approach to Smart Investing

For investors looking for passive income and strong risk-adjusted returns, real estate private equity provides an efficient solution:

- No management headaches – Professional operators handle day-to-day oversight.

- Institutional-grade investments – Access to larger, stabilized properties.

- Tax efficiency – Maximized returns through strategic tax planning.

- Diversification – Investments across multiple properties and markets.

At Cramlet Capital, we specialize in value-add multifamily syndications and private equity real estate investments, delivering:

- 8% preferred returns

- 40-80% bonus depreciation (tax benefits)

- 2X+ equity multiple within 3-5 years

These returns outperform traditional stock market investments, offering predictable cash flow and significant wealth-building potential.

Next Steps:

Whether you’re a seasoned investor or new to passive investing, let’s work together to achieve your financial goals. Schedule a Call Now!